- The Core

- Posts

- The Sunday Budget: What To Expect

The Sunday Budget: What To Expect

The Weekend Playlist

For the first time in 27 years, the Union Budget is dropping on a Sunday. The last time a finance minister spent their weekend this way was Yashwant Sinha back in 1999. But the nostalgia ends there. The stakes today are distinctly modern.

India is currently navigating a tricky global map, facing tariff burdens from the US and a changing global order that has thrown multiple curveballs at our key sectors.

The GST 2.0 Dream

The government’s previous move to slash GST was a clear play to get people spending. Now, the industry is looking for the sequel. Krishan Arora, Indirect Tax National Leader at Grant Thornton Bharat LLP, told The Core that the GST 2.0 wishlist is topped by rate rationalisation and procedural simplification.

“I think the long-pending issues, such as rate rationalisation, the provisional simplification is what was on the cards. So industry now seeks timely and consistent implementation as well,” Arora noted on The Core Report podcast.

Direct Tax: Don't Hold Your Breath

While last year saw major direct tax overhauls to pump up consumer confidence, the experts are predicting a quieter day for your income tax slabs. Ajay Rotti, CEO of Tax Compaas, isn't expecting fireworks: "I will be surprised if there are too many things... I am expecting a non-event on February 1st."

The Private Investment Puzzle

The real elephant in the room? Sluggish private investment. Despite healthy corporate balance sheets and shrinking debt, the "vigorous" spending we need hasn't quite arrived. Economist Ajit Ranade points out that the foundation is there—profits are good—so the ball is in the government’s court to provide the spark.

Stay In The Loop

What else is hidden in the fine print? Stick with us today. We will update your inbox throughout the day with highlights and the "so what?" analysis you actually need.

Live Stream: Check our social channels for real-time coverage.

The Deep Dive: Join journalist Govindraj Ethiraj on our YouTube channel at 5 PM for a live panel discussion with Gautam Khattar, Principal, Price Waterhouse & Co LLP, Uday Ved, Partner, KNAV & Jairaj Purandare, Founder Chairman, JMP Advisors.

Meanwhile here’s this week’s rewind of The Core Report

SPECIAL EDITION (Energy Special)

Oil surplus in 2026? Why the data may be lying

Govindraj Ethiraj in conversation with Anas Alhaji

As India Energy Week concluded earlier this week, here’s a timely reality check on global oil markets.

The “massive oil surplus” forecast for 2026 is misleading.

Widely cited projections from agencies and banks rely on headline supply-demand numbers that ignore how oil actually moves, trades, and gets stored.Why oil price crash predictions keep failing.

Repeated calls of collapsing prices haven’t materialised because surplus estimates often double-count oil in transit, misread inventories, and overlook strategic stockpiling.Inventory data isn’t as clean as it looks.

Oil sitting in ships, diverted cargoes, and opaque strategic reserves—especially in China—distort the picture of excess supply.Trade flows matter more than production numbers.

From Brazil and Kazakhstan to Venezuela, Russia, and the US, shifting routes and sanctions-driven rerouting are reshaping availability, not flooding markets.Geopolitics is overpowering market theory.

Sanctions, energy security concerns, and state-led decisions increasingly determine where oil goes and at what price—not textbook supply curves.India and Asia sit at the centre of this recalibration.

India’s import strategy, Russia’s evolving role, LNG supply expectations, and China’s stockpiling behaviour all point to tighter balances than forecasts suggest.The takeaway for 2026 and beyond:

Don’t expect dramatic crashes or runaway spikes. Oil markets are likely to remain strategically balanced, not structurally oversupplied.

For anyone tracking energy markets after India Energy Week, this conversation cuts through the noise—and explains why the oil surplus story doesn’t quite add up.

THE MEDIA ROOM

How Hoichoi Made Money While Indian OTT Chased Scale

Vanita Kohli-Kandekar in conversation with Vishnu Mohta, Co-Founder, Hoichoi

While most Indian OTT platforms chased scale, languages, and blockbuster hits, Hoichoi did the opposite—and won.

In a recent episode of The Media Room, Hoichoi co-founder Vishnu Mohta explains how a Bengali-only streaming platform became one of India’s few profitable OTT services, years before much larger players.

The bet was simple but unfashionable:

one language, one audience, subscriptions first.

Hoichoi resisted the urge to expand into multiple languages or rely on advertising-led growth. Instead, it focused on building daily viewing habits among Bengali audiences across India, Bangladesh, and the global diaspora—treating the language as a market large enough to sustain serious economics.

That focus shaped everything:

Originals designed for repeat engagement, not weekend spikes

Tight control over IP ownership and production costs

A steady slate of shows rather than expensive tentpoles

Profitability achieved without burning capital to chase scale

Backed by SVF Entertainment’s 30-year content legacy, Hoichoi could take long-term bets—experimenting with micro-payments, audio storytelling, TV-plus formats, and even micro-dramas, while staying disciplined about growth.

The lesson Mohta keeps returning to is uncomfortable for venture-funded media:

Growth without habits is noise. Discipline beats scale.

As Indian streaming enters a phase of slower funding and tougher monetisation, Hoichoi offers a counter-intuitive playbook—own a niche deeply, charge early, and grow only when the unit economics work.

Sometimes, the future of OTT isn’t about being everywhere.

It’s about being indispensable somewhere.

THE CORE QUIZ

How large is current India-EU bilateral trade, which the new FTA aims to expand? |

MESSAGE FROM OUR SPONSOR

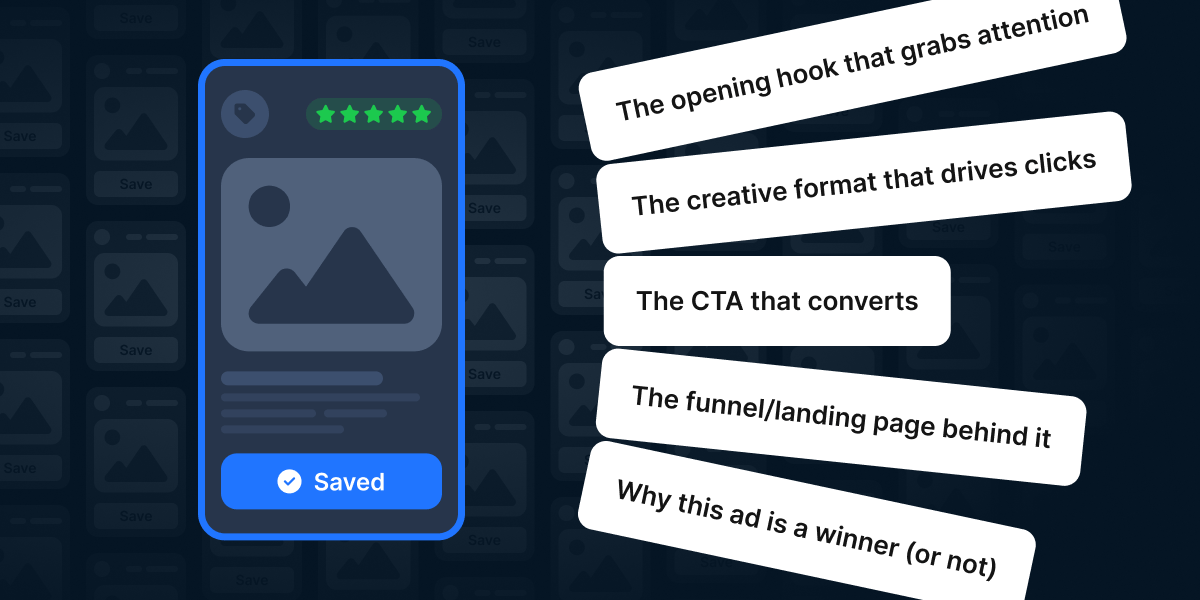

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

THE TEAM

✍️ Zinal Dedhia, Kudrat Wadhwa | ✂️ Rohini Chatterji | 📹️ Maitrayee Iyer | 🎧 Joshua Thomas

🤝 Reach 80k+ CXOs? Partner with us.

✉️ Got questions or feedback? Reach out.

💰 Like The Core? Support us.