- The Core

- Posts

- From US Shutdown to Bihar Polls

From US Shutdown to Bihar Polls

Good Morning. Shutdowns, showdowns, and a trillion-dollar bonus—this week had it all. The US averted a crisis, Nifty scaled 26,000, Bihar voted big, and Elon Musk got even richer. Global chaos, Indian calm—plenty to unpack this week.

Indian markets closed flat on Thursday, with the Sensex inching up 12 points to 84,478.67 and the Nifty adding just 3 points to finish at 25,879.15.

In other news, India is set to outpace G20 peers with 6.5% annual growth through 2027. Meanwhile, India seeks to avert CITES import curbs amid probe into Ambani’s Vantara zoo transfers.

From US Shutdown to Bihar Polls: Market Optimism, Terror Attacks, and Corporate Realities

The US government shutdown looks set to end after several Senate Democrats crossed the aisle to back Republicans—on the promise that Obamacare subsidies, scrapped under Trump’s “One Big Beautiful Bill Act,” will get another vote. Global markets cheered, with investors also eyeing a possible US–India trade deal carrying 15% tariffs. Back home, the Nifty climbed past 26,000, powered by domestic buyers even as foreign investors took profits and flew out.

Tesla shareholders just approved what could be the biggest pay package in history—shares worth $1 trillion for Elon Musk if he hits sky-high performance goals. Elsewhere, Sudan has replaced Gaza as the world’s atrocity headline, with rebel militias targeting non-Arab civilians. And Trump’s Nobel Peace Prize dreams? Not looking great—the Thailand–Cambodia ceasefire unraveled faster than expected.

Closer home, Delhi reeled from a November 10 car explosion near the Red Fort that killed 13. The driver, a radicalised doctor, reportedly led a team of educated professionals plotting coordinated terror strikes. A massive cache of explosives found in Faridabad has renewed fears of domestic radicalism.

Despite that, Indian markets remain upbeat as Bihar awaits election results on November 14. Exit polls predict a BJP-led NDA return, helped by a promise to credit Rs 10,000 each to one crore women for self-employment. Analysts say freebies like these are now baked into India’s political economy—great optics, bad economics.

Infosys joined the “risk-averse club,” announcing an Rs 18,000 crore buyback instead of investing in R&D (still <1% of revenue). Meanwhile, Tata Motors split its passenger and commercial vehicle units, a rare efficiency move in Indian corporate land. And Ola got a reality check—its parent company’s rating downgrade reminded investors that modest IPO gains often mean fair pricing, not failure.

Markets up, Musk richer, Bihar voting done—just another week in the global bazaar.

MESSAGE FROM OUR SPONSOR

Simplifying GST for Large Enterprises

Masters India is one of the biggest GST Suvidha Providers (GSP) under Goods and Services Tax Network (GSTN). Through our advanced solutions our mission is to assist businesses simplify their required compliance and workloads. We create smart compliance automation tools to help businesses simplify their compliance activities and run their operations more effectively. Join us as we continue to innovate and deliver actionable insights, strategic tools, and exceptional support to help enterprises stay ahead in the ever-evolving financial landscape.

CORE NUMBER

Rs 45,060 crore

That’s the value of ‘Export Promotion Mission (EPM)’, which the Union Cabinet chaired by PM Modi approved at 8:15 pm on Wednesday. Over the next six years, this exporter program will allocate Rs 20,000 crore to credit guarantees on bank loans and Rs 25,060 crore to logistics and market support to exporters to help offset the impact of recent US tariff hikes.

Right now, the US charges a 50% tariff on Indian exports like garments, jewellery, leather goods and chemicals. This duty has hit labour-intensive sectors like textiles, jewellery and seafood the hardest, causing job losses in industrial hubs in Tamil Nadu and PM Modi’s home state of Gujarat.

Fall in India’s merchandise exports → 12% y-o-y

Pre-fall value → Rs 51,400 crore

Post-fall value → Rs 45,200 crore

But, that could soon change. US President Trump said Washington was close to a deal with India to expand economic and security ties, an agreement New Delhi hopes could deliver an initial rollback of the punitive tariffs.

MESSAGE FROM OUR SPONSOR

Debt sucks. Getting out doesn’t have to.

Americans’ credit card debt has surpassed $1.2 trillion, and high interest rates are making it harder to catch up (yes, even if you’re making your payments). If you’re in the same boat as millions of Americans, debt relief companies could help by negotiating directly with creditors to reduce what you owe by up to 60%. Check out Money’s list of the best debt relief programs, answer a few short questions, and get your free rate today.

FROM THE PERIPHERY

India to Top G20 Growth!

India will remain the fastest-growing economy among G20 nations over the next two years, with GDP expected to expand 6.5% through 2027, PTI reported citing Moody’s Ratings in its Global Macro Outlook 2026–27 report. Growth will be driven by robust infrastructure spending, strong consumer demand, and export diversification, even as private sector investment stays cautious.

Fast Facts: Despite facing 50% US tariffs on some goods, Indian exporters have redirected trade, helping overall exports rise 6.75% in September even as shipments to the US fell 11.9%. Moody’s said India’s resilience is supported by stable monetary policy, easing inflation, and strong capital inflows. The RBI’s decision to hold rates steady reflects its cautious stance amid steady growth.

Future: Globally, the agency projects GDP growth of around 2.5–2.6% in 2026–27, led by emerging markets expanding close to 4%. The US and Europe will see moderate growth, while China’s expansion is expected to slow from 5% in 2025 to 4.2% by 2027.

Vantara Zoo Cleared.

India has urged the U.N. wildlife trade body, CITES, not to restrict its imports of endangered species, saying it has strengthened its oversight. The move comes amid allegations of irregular animal shipments to Vantara, a 3,500-acre zoo in Gujarat run by billionaire Mukesh Ambani’s philanthropic arm, Reuters reported.

Flashpoint: Indian investigators, appointed by the Supreme Court, cleared Vantara of wrongdoing in September, but a recent CITES report cited data discrepancies and weak checks on animal origins, urging India to halt new import permits.

What's Next? In its November 10 submission, India said such curbs would be “premature and disproportionate.” CITES had acknowledged Vantara’s “exceptionally high standards” but sought stronger safeguards. India has since reinforced inspection and reporting mechanisms across all zoos and rescue facilities.

India Imposes Duty.

India has imposed a five-year anti-dumping duty on hot-rolled flat products of alloy or non-alloy steel imported from Vietnam to protect domestic producers from below-cost imports. The Finance Ministry’s notification, issued Thursday, follows the Directorate General of Trade Remedies’ (DGTR) findings in August that Vietnamese steel was being dumped at prices lower than the normal value, causing material injury to India’s steel industry.

Why It Matters: The duty of $121.55 per metric tonne applies to all Vietnamese producers and exporters, except Hoa Phat Dung Quat Steel JSC, which has been exempted, The Business Standard reported. It covers hot-rolled flat steel products, not plated or coated, with a thickness up to 25 mm and a width up to 2,100 mm.

Future: The levy will remain effective for five years from publication unless revoked, superseded, or amended earlier, and will be payable in Indian currency.

PODCASTS

On Episode 725 of The Core Report, financial journalist Govindraj Ethiraj talks to Ramesh S Damani, Member at the Bombay Stock Exchange (BSE) as well as Chirag Doshi, Chief investment Officer-Fixed Income at LGT Wealth India.

The earnings story sinks in as mid caps race ahead

Moody’s says India will grow at 6.5%

Market watchers are predict

ing an oil glut next year which is good news for India

What India’s ambitious $5 billion export promotion mission needs to become a reality

What low inflation levels mean for fixed income in general and specific

The art of writing letters to shareholders and insights from the world’s greatest investor

MESSAGE FROM OUR SPONSOR

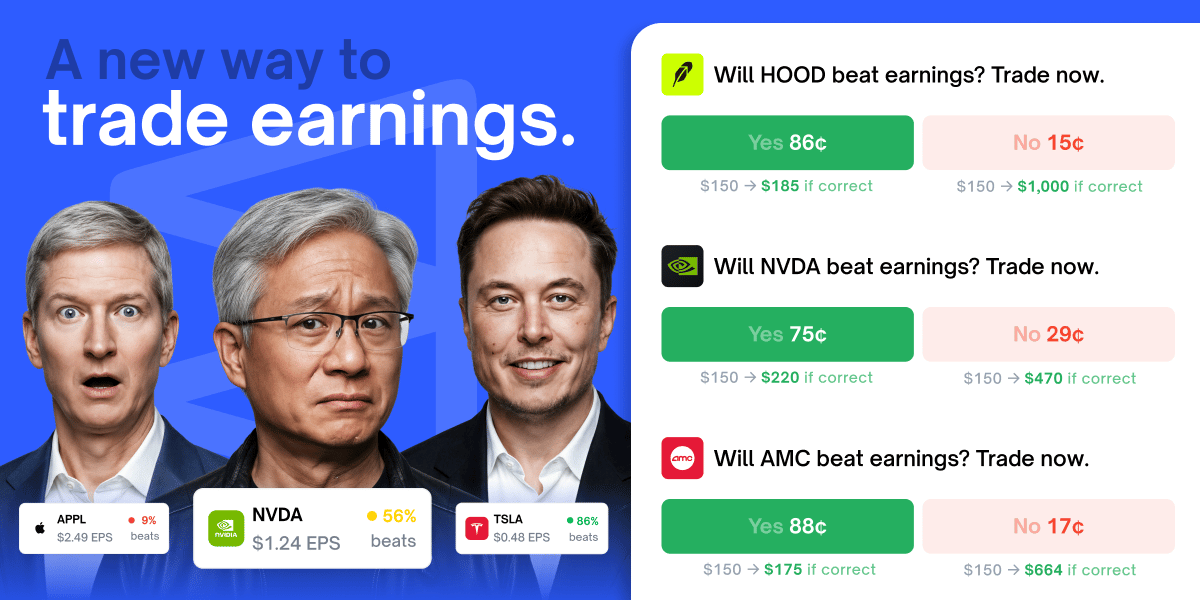

Breaking: Earning Markets are now LIVE on Polymarket 🚨

Turn a question into profit in one click with Polymarket’s new Earnings Markets. You can now trade yes/no on outcomes of your favorite companies:

Will Robinhood beat earnings?

Will Nvidia mention China?

Will Figma miss estimated EPS?

Earning Markets allow you to:

Trade simple Yes/No binary outcomes around earnings

Stay focused and isolate the specific event you want to trade

Be flexible with with entering, hedging, or exiting your position at any time

Upcoming markets include FIGMA, ROBINHOOD, AMC, NVIDIA, and more. Built for how traders actually trade.

THE TEAM

✍️ Zinal Dedhia, Kudrat Wadhwa, Shubhangi Bhatia | ✂️ Rohini Chatterji | 🎧 Joshua Thomas

🤝 Reach 80k+ CXOs? Partner with us.

✉️ Got questions or feedback? Reach out.

💰 Like The Core? Support us.