- The Core

- Posts

- Cement Industry’s Next Big Test

Cement Industry’s Next Big Test

Good Morning. After years of dealmaking and capacity grabs, India’s cement industry is shifting gears. With M&A slowing and new capacity coming online, 2026 will hinge on execution—cutting costs, sweating assets and defending market share. Will this operational grind redefine winners and losers in a sector long driven by expansion?

Indian equity benchmarks closed lower for a third straight session on Wednesday, with the Nifty slipping below 25,900. The Sensex fell 120.21 points, or 0.14%, to 84,559.65, while the Nifty declined 41.55 points, or 0.16%, to 25,818.55.

In other news, IndiGo founders enter Hurun’s top-10 self-made entrepreneurs list. Meanwhile, India’s Russian crude imports are set to top 1 million bpd despite US sanctions.

After Expansion Spree, India’s Cement Majors Will Have To Get To Work In 2026

What?

After hunting, shopping and bickering over asset buys for years, India’s cement industry is preparing for a very different year ahead. With deal making slowing and capacity actions piling up, 2026 is shaping up as a year of the operational grind.

For cement companies it would be a year focused on cost reduction, sweating existing assets and bolstering market leadership, rather than the headline grabbing acquisitions or price hikes we have seen in the past years.

India’s ever-consolidating cement sector took a breather from its intense deal activity in 2025, except for the expected Adani-Jaypee transaction.

Why?

In the next 12 months to follow, it will all be about extracting efficiencies from recently acquired assets, even as pricing power remains elusive and utilisation stays below comfort levels.

Large cement makers are expected to sharpen cost synergies by optimising their logistics, fuel mix changes and scale advantages. While consolidation may not completely stop, acquisition activity is expected to taper, with smaller players continuing to walk a tightrope as they struggle to compete with the cost structures of industry leaders.

Industry analysts expect similar cost-cutting measures across the sector. Fuel efficiency, logistics optimisation and large companies flexing their ‘economies of scale’ muscle are actions likely to be seen in the next few quarters.

“The emphasis will shift more to optimising and monetising existing/recently acquired assets.” said Ravleen Sethi, director of large corporate ratings, at CareEdge.

What's Next?

The cement industry has seen a flurry of consolidation in the last three years, in the run up to 2026. The Adani Group acquired Holcim’s India assets in 2022, becoming the new owners of Ambuja Cements. UltraTech Cement expanded with Kesoram Industries, India Cements and others, while Adani responded with stakes picked in Penna Cement, Orient Cement amongst others and is expected to be the likely buyer for Jaypee Group’s cement assets, as part of a debt resolution plan.

This buying spree is now losing momentum.

Analysts with Systematix in a recent note said that while M&A consolidation will continue — mainly for strategic access to limestone reserves held by smaller players — its intensity is likely to moderate. Greenfield or brownfield expansion costs about $60–70 per tonne, compared to $90–100 per tonne with acquisitions, making smaller regional players the primary consolidation targets.

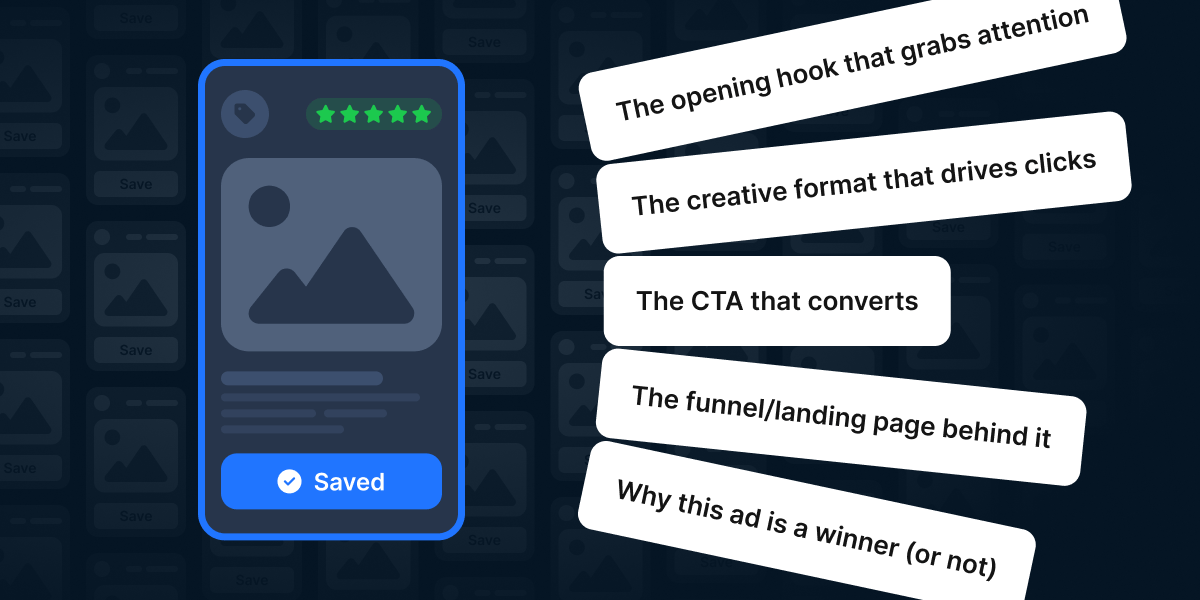

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

Rs 42 lakh crore

That’s the combined value of the companies created by the ‘Top 200 Self-Made Entrepreneurs of the Millennia’ by IDFC FIRST Private & Hurun India. Their value grew 15% this year from Rs 36 lakh crore last year, underscoring the rapid wealth creation amongst self-made entrepreneurs.

Interestingly, this year’s list saw Radhakrishna Damani of Avenue Supermarts slip to the second place, with Eternal’s Deepinder Goyal at the top. The former’s company valuation dropped 13% while the latter’s rose 27%.

Top 5 self-made entrepreneurs & their company valuations

· Deepinder Goyal of Eternal: Rs 3.2 lakh crore

· Radhakrishnan Damani of Avenue Supermarts: Rs 2.97 lakh cr

· Rahul Bhatia & Gangawal of InterGlobe Aviation: Rs 2.19 lakh cr

· Abhay Soi of Max Healthcare Institute: Rs 1.1 lakh cr

· Sriharsha Majety & Nandan Reddy: Rs 1.06 lakh cr

While Mumbai is the billionaire capital of the country, when it comes to self-made entrepreneurs, Bangalore leads with 88 entrepreneurs, ahead of the financial capital’s 83. Financial services tops the list with 47 companies, followed by software and services at 27 and retail at 20.

Russian Oil Returns

India’s imports of Russian crude are set to exceed 1 million barrels a day in December, defying expectations of a sharp slowdown after US sanctions, Reuters reported citing sources.

By The Numbers: Preliminary LSEG data shows arrivals could cross 1.2 million bpd and average up to 1.5 million bpd by month-end, driven by discounted supplies from non-sanctioned entities. Imports rose to 1.77 million bpd in November, up 3.4% from October, making India Russia’s biggest seaborne buyer.

What’s Next? While January volumes may ease after Reliance Industries halted purchases, state refiners are returning to the market, drawn by Russian crude discounted about $6 a barrel to dated Brent. Russian producers are using domestic swaps to keep exports flowing.

Steel Up, Then Down

Indian steel exports will slow down as global demand weakens, according to a report by brokerage firm Elara Capital. The firm said overseas orders have begun to dry up after a sharp but temporary jump in shipments.

Pivot: Indian steel exports rose about 83% in October to around 0.73 million tonnes, helped by European buyers advancing purchases ahead of carbon border taxes. However, Elara expects export volumes to moderate from December as new orders thin out. Meanwhile, domestic steel production increased by about 6% in October, adding to supply pressures at home. A separate report by Investment Information and Credit Rating Agency (ICRA) says that domestic demand will grow about 8% in FY26, but oversupply and weak prices could keep margins under pressure.

Impact: Elara said profitability across the steel sector could remain under pressure, and noted that aluminium producers may perform better in the current environment.

AI Freebie War

OpenAI, Google and Perplexity are locked in an intense battle for AI users in India, using free subscriptions to expand adoption and gather valuable multilingual data rapidly, Reuters reported. With 730 million smartphones, ultra-cheap mobile data and massive daily usage, India offers unmatched scale.

Flashpoint: Google has rolled out free and discounted Gemini plans through Reliance Jio, while OpenAI has made its ChatGPT Go plan free exclusively in India. Perplexity has followed suit via Airtel users.

What's Next: According to Reuters, India is now the largest market by daily users for both ChatGPT and Gemini, with usage surging sharply. Analysts say these giveaways are less about generosity and more about tapping India’s linguistic diversity to train AI systems on complex, real-world communication patterns.

Coal’s Long Plateau

Global coal demand hit a record high in 2025 but is expected to begin a gradual decline by 2030 as renewables, nuclear power and abundant natural gas erode its dominance in power generation, the International Energy Agency (IEA) said. Coal remains the world’s largest source of electricity, making its phase-down critical to meeting climate goals.

Flashpoint: In its Coal 2025 report, the IEA forecast demand rising 0.5% this year to a record 8.85 billion metric tons before plateauing and edging lower later in the decade.

Overview: Trends diverged across regions. India’s coal use fell due to strong monsoons boosting hydropower, while U.S. consumption rose on higher gas prices. China’s demand was largely flat and is expected to ease slightly by 2030, though risks remain.

Powered by the next-generation CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

✍️ Zinal Dedhia, Kudrat Wadhwa, Shubhangi Bhatia | ✂️ Rohini Chatterji | 🎧 Joshua Thomas

🤝 Reach 80k+ CXOs? Partner with us.

✉️ Got questions or feedback? Reach out.

💰 Like The Core? Support us.